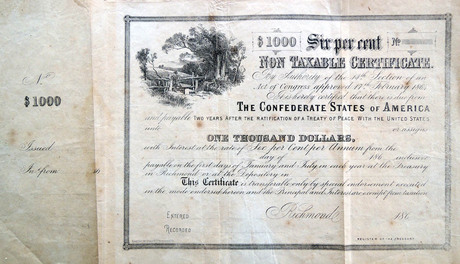

Two engraved certificates turned up this week in the Graphic Arts Collection. The first is a $1000 non taxable certificate, dated 17 February 1864, due from The Confederate States of America and payable two years after the ratification of a treaty of peace with the United States (we haven’t figured what the interest would be at 6% per year).

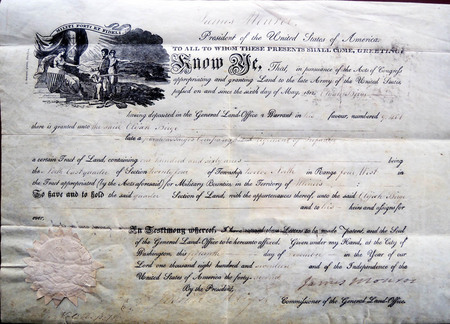

The second is a certificate granting a tract of land in the Territory of Illinois, dated 6 May 1812 and signed by James Monroe. At this time, Monroe was Secretary of State and not long after this, appointed the Secretary of War under President James Madison.

“A similar issue of 6 % non-taxable certificates was also authorized with which to pay for government supplies, if agreeable to contractors. These were not intended for general circulation, as they were made transferable by endorsement only. The expenses of the government were further to be met out of the proceeds of a new bond issue for 500 millions bearing 6 % interest. The interest and principal of these bonds were exempt from taxation, and their payment was secured by the net receipts of any export duty hereafter to be levied upon cotton, tobacco, and naval stores, and also by the net proceeds of the import duties. The former never materialized, and the latter amounted to an insignificant sum.”

“As to the effect of the Funding Act, the popular belief that prices would fall was not realized. Immediately upon the passage of the act there were complaints of a scarcity of currency, a familiar phenomenon at the time of inflation.”

—John Christopher Schwab, The Confederate States of America, 1861-1865: A Financial and Industrial History of the South During the Civil War (1901). Firestone E487.S393 1901